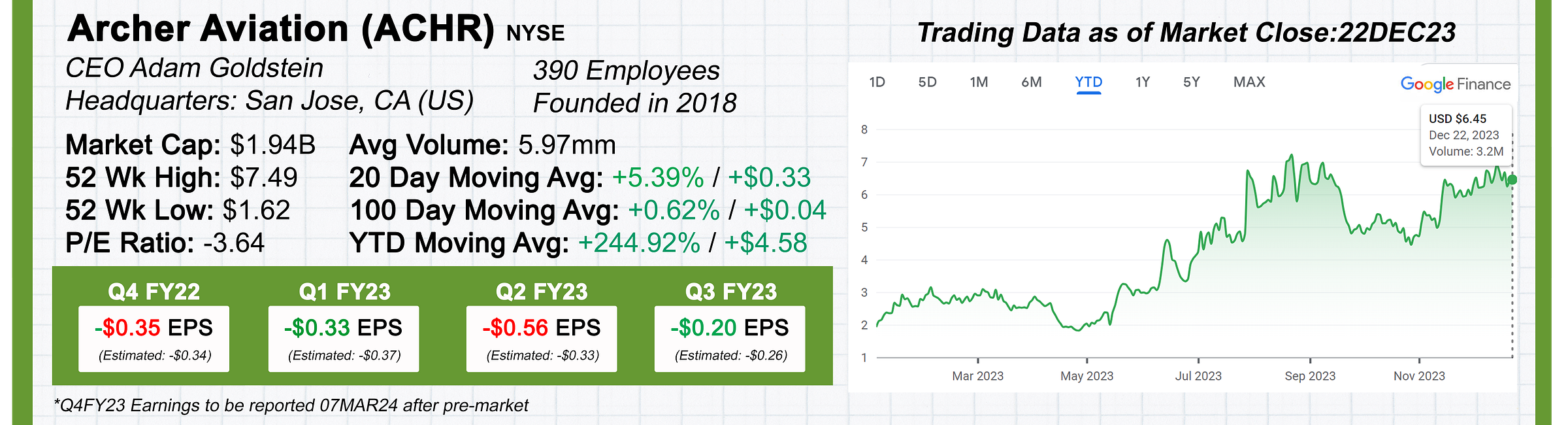

When we last talked about Archer Aviation (ACHR) (see the original post below), we had placed it on the “Checking My Math” watchlist and were looking for a small pullback from its $6.45 stock price to a fairer entry range of $6-$6.15.

UPDATE: 01/12/24

Since our original post ACHR (12/26/23) has lost -19.20% over twelve trading days, its current price being $5.22 (01/11/24 close). While the price decline aligns with our original expectations of a pullback, the drop rate has been some cause for alarm. Since there has not been any wild fluctuation in volume, nor has negative news seemingly sparked the price movement, ACHR is in a correction cycle from its run-up in December 2023. ACHR remains on the “Checking My Math” watchlist. We still think 2024 will have forward momentum for ACHR’s stock price, but also now believe it needs to return to its previous November 2023 trading range of $4.60-$5.10 before any sustainable gains can be made.

You can keep track of Archer Aviation and all the companies we have covered in Spotlight by checking out the Ledger Island Watchlists.

And make sure you subscribe for FREE today to get all our posts and updates here at Ledger Island.

ORIGINAL POST: 12/26/23

Archer Aviation (ACHR) is a PRE-REVENUE / SMALL CAP company founded in 2018 and began public trading on the NYSE in September 2021. In their own words from numerous Archer Aviation press releases:

“Archer is designing and developing electric vertical take-off and landing aircraft for use in urban air mobility networks. Archer’s mission is to unlock the skies, freeing everyone to reimagine how they move and spend time.” [https://www.archer.com/news]

Clint’s Take:

I am very bullish on the eVTOL (Electric Vertical Take-Off and Landing) market, and Archer Aviation (ACHR) is my favorite. While the internet is a buzz with “flying car” videos and speculation (which I don’t see as a viable investment at this time), ACHR is building manufacturing partnerships with Stellantis (STLA), securing government contracts with the US Air Force, and moving forward with air taxi routes in conjunction with United Airlines (UAL) in the NJ/NY metro areas.

The Midnight aircraft continues to be the driving force for ACHR. Capable of carrying (4) passengers plus a pilot for distances up to 100 miles, this completely electric, quiet tech air carrier will be a game changer, particularly in built-up urban areas. Able to recharge for 20-mile flights in 12 minutes, I wouldn’t be surprised if battery technology becomes another revenue stream for this company, just as the military troop deployment application has become. Currently, all milestones and checkmarks with production and FAA regulations seem to be on track with the company’s forecast.

3rd quarter results for FY2023, beating EPS expectations by .06 (-.26 expected / -.20 reported), seem to have become a turning point for the stock price over the past month, and I think that trend continues through 2024. Operating costs seem manageable for a pre-revenue company, and volume suggests more people are getting “in” than “out” on ACHR. Heading into what is typically the December selloffs, there might be opportunities to create a value-insulated position in ACHR.

Phil’s Take:

The trend lines are strong with this one. With such a theoretical market, I want to see names I recognize and trust buying into the concept. A contract with the US Air Force and investments from Boeing, United Airlines, and Stellantis are good signs. My biggest questions are about their path to profitability. I’m always a little hesitant with a market that is this theoretical. Are they more of a transportation company, or are they a technology company? If Clint is right about the battery technology being marketable on its own, this stock may have its own vertical take-off. On the numbers front, there’s not a lot that worries me. It tends to respond well to positive press and has been slowly creeping upwards over the last year. The risk for me is trying to time my buy. Good news about a purchase could come at any point, and we could still see a slight downturn in the new year as the market adjusts. ACHR is a long hold for me, so I’ll be watching the market closely and timing my buy with the understanding that I’ll have ACHR on my ledger for quite a while.

Moving Forward: (This post’s Moving Forward has been updated above)

We think 2024 will be a good year for ACHR, barring any setbacks, so we are placing it on the “Checking My Math” watchlist. The US Air Force payments will start filtering in and should reflect in Q4 FY2023, and based on the Q3 expectations beat response and a general belief that a small-cap boom is on the horizon for 2024, we would likely buy sooner rather than later. To Phil’s point on the newness of eVTOL, we will look at other names in this space (Joby Aviation JOBY and Blade Air Mobility BLDE) in the coming weeks for comparative data. Currently, ACHR is hovering at a $6.50 range. We are looking for some short-term pullback and would like a $6-$6.15 entry point to give the position a stable floor against future volatility.

You can keep track of Archer Aviation and all the companies we have covered in Spotlight by checking out the Ledger Island Watchlists.

Make sure you subscribe today to get our updates on Archer Aviation and all the companies we discuss here in Ledger Island Spotlight.